The proceed of a "fiscal cliff," a death of a horde of taxation and spending provisions, has extended implications for probably each American as chronicled in last week's front-page story in a Chattanooga Times Free Press.

In particular, investors should be wakeful of a integrate of poignant taxation supplies due to take outcome (or some-more rightly to expire) on New Year's Day, and should cruise holding movement now to lessen a intensity impact to their portfolios.

As of Jan. 1, many of a taxation cuts enacted in 2001 and 2003 are scheduled to sunset, permitting taxation rates to return to their prior levels. Although there are countless facets to a mercantile cliff, investors are quite influenced by a reversal of a rates on division income and long-term collateral gains. Going up, in box we were wondering.

The story of taxation on division income is tortuous, though a reasonable concede was determined in 2003 when a taxation rate on competent dividends was reduced to 15 percent.

Prior to a 2003 cut, dividends were treated as typical income and taxed during a tip extrinsic rate to that a taxpayer was subject. This rate was quite toilsome given dividends are distributions of corporate gain thatalready have been taxed during a association turn and that are not deductible as corporate expenses.

The scheduled changes meant that taxes on division income for a integrate filing jointly with an practiced sum income of $70,000 will burst from 15 percent to during slightest 25 percent and maybe 28 percent. Filers in a top income joint are slated to compensate 43.4 percent, including a new 3.8 percent surcharge to assistance account doing of a Affordable Care Act.

In expectation of a additional belt to shareholders, some open and many private companies are considering a acceleration of Jan division payouts into Dec to kick a taxation clock, during slightest for this quarter's distribution.

While it is doubtful that Congress will concede such a pointy boost to occur, high-dividend bonds would expected knowledge some offered vigour if a concede fails to emerge.

Perhaps some-more significantly, collateral gains taxes also are scheduled to boost in January, with rates augmenting from 15 percent to 20 percent for many taxpayers holding a batch for during slightest one year. However, a best wish of a grand discount on debt rebate centers around a offer to revoke typical income taxation rates though also to boost collateral gains to 25 percent. Any devise with a reasonable possibility of adoption would roughly positively embody some movement on this theme.

Given this scenario, a reassessment of required knowledge is appropriate.

In particular, investors who have amassed vast strong positions and are traditionally antithetic to realizing taxation gains should reconsider, given a odds that a taxation check subsequent year will be worse, and presumably most worse.

No one ever went pennyless by holding profits, as a observant goes. And remember that holding no movement is also a decision, one that competence outcome in a incomparable grant subsequent year to Uncle Sam.

Christopher A. Hopkins, CFA, is a clamp boss during BarnettCo.

Source: http://financial.ahipcup.com/personalfinance-looming-tax-hikes-suggest-investor-action/

pollyanna samuel adams snowy owl one for the money 10 minute trainer sarah burke death etta james funeral

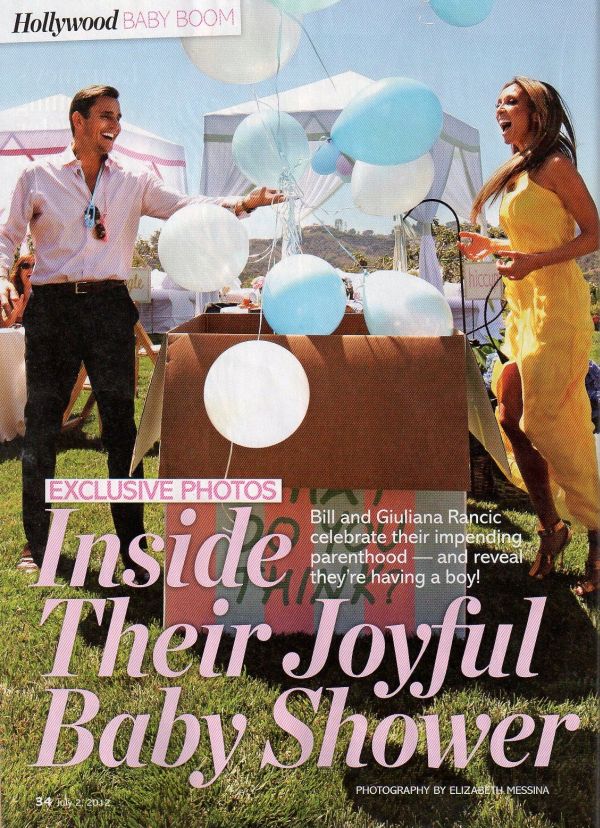

The excited and happy couple!!

The excited and happy couple!! Super cute signs with words like ?giggle,? ?wiggle,? ?crawl,? and ?lullaby? were place all over!!

Super cute signs with words like ?giggle,? ?wiggle,? ?crawl,? and ?lullaby? were place all over!!

ONEHOPE donates half of its profits to designated charities? proceeds from their Chardonnay go toward the Fight Against Breast Cancer.

ONEHOPE donates half of its profits to designated charities? proceeds from their Chardonnay go toward the Fight Against Breast Cancer. We have a soft spot for flowy tents!

We have a soft spot for flowy tents!

Giuliana checked out a few scents from the custom perfume bar by Kamilyin!

Giuliana checked out a few scents from the custom perfume bar by Kamilyin!

Adorable onesies doubled as decor! So sweet!

Adorable onesies doubled as decor! So sweet! This box filled with balloons had guests on their toes!

This box filled with balloons had guests on their toes!

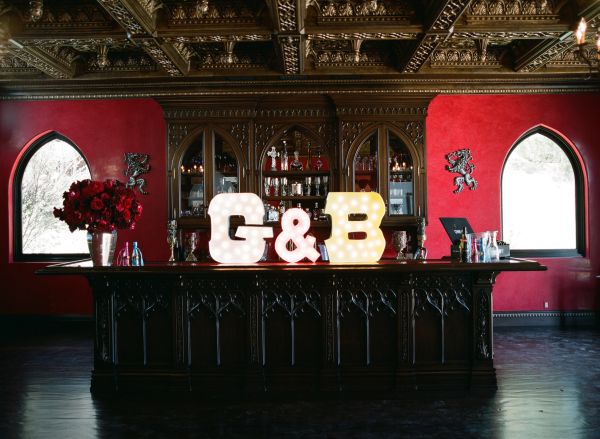

This red and black bar is amazing!! We love the huge G & B letters!

This red and black bar is amazing!! We love the huge G & B letters!

How cute is this bookmark station?! Just to make sure that Dad gets some loving, too :)

How cute is this bookmark station?! Just to make sure that Dad gets some loving, too :)

There was a little Sweet Lucies ice cream station! We are obsessed with this organic goodness :)

There was a little Sweet Lucies ice cream station! We are obsessed with this organic goodness :)

Cake push pops, monogrammed cookies and yummy macarons by Cupcakes Couture of Manhattan Beach!!

Cake push pops, monogrammed cookies and yummy macarons by Cupcakes Couture of Manhattan Beach!!

A picture we snapped with the expecting couple after the shower!!

A picture we snapped with the expecting couple after the shower!!